Strata Insurance

The Strata Property Act requires the strata corporation to provide insurance as follows.

Property insurance required for strata corporation

149 (1) The strata corporation must obtain and maintain property insurance on (a) common property, (b) common assets, (c) buildings shown on the strata plan, and (d) fixtures built or installed on a strata lot, if the fixtures are built or installed by the owner developer as part of the original construction on the strata lot.(4) The property insurance must (a) be on the basis of full replacement value, and (b) insure against major perils, as set out in the regulations, and any other perils specified in the bylaws.

150 (1) The strata corporation must obtain and maintain liability insurance to insure the strata corporation against liability for property damage and bodily injury.

(2) The insurance must be of at least the amount required in the regulations.

151 The strata corporation may obtain and maintain errors and omissions insurance for council members against their liability and expenses for errors and omissions made in the exercise of their powers and performance of their duties as council members.

155 Despite the terms of the insurance policy, named insureds in a strata corporation’s insurance policy include (a) the strata corporation, (b) the owners and tenants from time to time of the strata lots shown on the strata plan, and (c) the persons who normally occupy the strata lots.Application of insurance money

157 Insurance money received under section 156 with respect to damaged property must be used to repair or replace the damaged property without delay unless the strata corporation decides not to make the repair or replacement under section 159.Insurance deductible

158 (1) Subject to the regulations, the payment of an insurance deductible in respect of a claim on the strata corporation’s insurance is a common expense to be contributed to by means of strata fees calculated in accordance with section 99 (2) or 100 (1).(2) Subsection (1) does not limit the capacity of the strata corporation to sue an owner in order to recover the deductible portion of an insurance claim if the owner is responsible for the loss or damage that gave rise to the claim.(3) Despite any other section of this Act or the regulations, strata corporation approval is not required for a special levy or for an expenditure from the contingency reserve fund to cover an insurance deductible required to be paid by the strata corporation to repair or replace damaged property, unless the strata corporation has decided not to repair or replace under section 159.

159 (1) The strata corporation may, by a resolution passed by a 3/4 vote at an annual or special general meeting held no later than 60 days after the receipt of the money referred to in section 156, decide not to repair or replace the damaged property.(2) Subject to section 160, if the strata corporation decides not to repair or replace the damaged property, the insurance trustee or the strata corporation that receives the payment under subsection (1) of this section holds the money and any interest on the money in trust for each person who has an interest in the money, including the holder of a registered charge, and(a) must distribute the money according to each person’s interest, or

(b) if an application is made under section 160, must distribute the money in accordance with the order made under that section.

insurance is a contract, represented by a policy; pools risks to make payments more affordable; used to hedge against risk of losses that may result from damage or liability for injury (eg."all in it together" strata policy & deductible, replacement value -db)

http://www.bclaws.ca/civix/document/id/complete/statreg/98043_09

the SPA governs s149 water damage repair, s155 named insureds include owners despite terms of strata's policy, s156 insurance proceeds are paid to strata in TRUST until paid under s157, strata pays s158 deductible, or sues if it can prove owner is responsible (strata insurance seems like a trust -db)

https://www.valuepenguin.com/choosing-homeowners-insurance-deductible

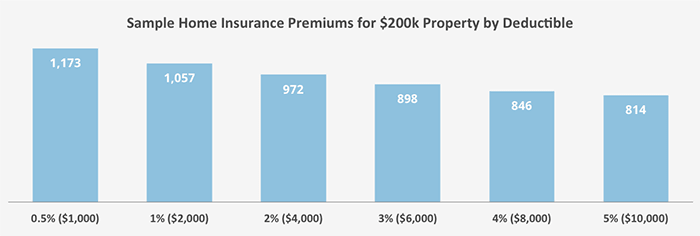

a deductible is the amount of money a policyholder must pay out-of-pocket toward damages or a loss before their insurance company will pay for a claim (s.158 strata pays deductible per s.99 strata fees, otherwise strata must sue to prove an owner is responsible to pay -db)

This whole article is worth posting, with added emphasis (and comment)

The SPA way treats major perils named in the policy as insured for full replacement value in all cases, with the deductible amount a common expense paid by s.99 strata fees. Filing a Proof of Loss by the strata or owner under s.155 for evaluation by the strata corporation's insurance adjuster and suing to prove an owner is responsible may be discretionary, but responsibility for replacement value repairs is not.

The other way is to treat the deductible portion as uninsured. This approach contradicts the SPA's mandatory requirement to provide "full replacement value insurance against major perils" as set out in the regulations, and any other perils specified in the bylaws. It encourages excessively high deductible amounts, induces strata corporations not to file a proof of loss or commence a claim for recovery on the strata corporation's all risk property policy within the requisite one year period following the occurrence of the loss, leaves damaged property unrepaired contrary to s.159, and attempts to offload insured risks onto individual owners contrary to the "all in it together" principle and the due process of law.

All of which is great for churning up legal disputes, but terrible for proper repairs and living in peace.

A 3-bedroom unit pays about 30% more of the strata corporation's insurance expense, indeed of all expenses, than a 2-bedroom unit.

Even though a strata corporation’s insurance policy includes the owners as named insureds by law, and it seems like a waste of money for an owner to pay insurance premiums and then not file a claim when there is damage, I found a rather interesting link explaining this issue at http://completechoiceinsurance.com/7-times-you-shouldnt-file-an-insurance-claim.

I have summarized it as follows:

Filing a lot of claims is almost certain to cost more in higher premiums over time than you will get from claim settlements. Insurance companies report claims to industry wide databases, so all of the companies can see your claim history. They set your rates based not only on their assessment of your risk of having property damage, but also for the risk to them that you will file a claim.

As a result, there are situations where you are better off not filing a claim. For example, if the policy has a deductible of $1,000 and the total damage is $900, then the insurance company won’t pay anything, and premiums could still go up. There is not much point in going through the hassle of filing a claim, getting the damage appraised by an insurance adjuster, and risking higher insurance premiums if it is likely that the damage is below the deductible and you won’t get a payout anyway.

Even if your claim would be more than the deductible and you would get a payout, if you have filed other recent claims, you are risking a significant increase in rates by filing another one. The average person files a claim about once every eight to 10 years, so if you file claims more frequently than average, you could be setting yourself up for higher rates.

If a police report is filed, your insurance company will likely find out about the incident whether you report it or not. One of the benefits of getting your insurance company involved is to handle a potentially expensive lawsuit. Even if your incident is minor, you may want to talk with your insurance company if you get the feeling that the other party may pursue a liability claim.

If the damage is a few thousand dollars or less, you might still come out ahead by paying out of pocket rather than filing a claim. You can avoid the risk of higher premiums for years and getting a record that can follow you even if you look for insurance from a different provider.

I can understand the strata having discretion to set the deductible, because no matter what the amount, it is a common expense. I can also understand the strata having discretion not to file an insurance claim for damage when it is unreasonable to do so, because replacement value repairs are mandatory in any event.Dog bites, water damage, and slip-and-fall claims are most likely to trigger rate increases on your homeowners insurance, according to Bankrate. Some insurance agents are obligated to report inquiries to the insurance company, and a mere inquiry about your coverage can be used to raise your rates due to the increased risk that you may file a claim. You can also ask your agent if they are obligated to report the inquiry to the insurance company before you start talking about a potential claim.

I have a huge problem, however, when stratas set perversely high deductibles or purposefully avoid getting the damage appraised by an insurance adjuster in order to defeat their statutory obligation to provide replacement value repairs, and instead leave strata lots with unrepaired damage, especially when the strata or neighbours are responsible for that damage.

Our strata paid about $25,000 for replacement value repairs for 2003 water damage from a broken toilet that was self contained within a single lower unit and the responsibility of the owners themselves.

Damage confined to one unit is by necessity less extensive than the damage a few days earlier to two units, when water escaping from a broken toilet in the upper level Unit 510 flooded both the source unit and our Unit 409 below when nobody was home in either unit to turn off the water.

The owner responsible for the toilet tank in Unit 510 was in charge of negotiating insurance for the strata at the time. The deductible was $1,000 in the notice given for the AGM held within 2 months of the December 31, 2002 fiscal year end and $5,000 in the notice given for the AGM held within 2 months of the December 31, 2003 fiscal year end. I could not obtain a signed and dated copy of a policy actually in force at the time of loss.

In any case, the mandatory insurance required for major perils specifically includes full replacement value repairs for water damage, and as of 2018, the continuously incomplete repairs to Unit 409 are anything but full replacement value:

The strata lulled me into believing that the repairs to 409 would be completed and did not give me access to the insurance policy or advise me of my right to make a claim on the policy. It further prevented me from making a claim by starting to make repairs, which it then delayed until the time for a claim expired, leaving them incomplete.

The required vote for leaving damage unrepaired was not obtained since insurance money was not received because an unidentified member of the strata management team decided not to make the claim or complete the repairs.

I made extraordinary efforts to do everything in my power to obtain the required repairs and don't know whether to blame Garth Cambrey of Stratawest, Gloria Henderson of Unit 510, Sunridge Estates strata councils, or the whole combination for leaving 409 with all this unrepaired water damage. Regardless of blame, I think it's unlawful.

When properties like units 409 and 510 are insured for a named peril like water damage, changing the strata's deductible from $1,000 to $15,000 does not prohibit making the claim or deprive owners of full replacement value repairs.

Subsection (2) does not make an owner responsible for the deductible. Strata bylaws cannot either. Only a court can do that. The SPA requires the strata to sue the owner and meet the burden of proof; it is NOT the other way around.

I want the strata to complete the repairs or pay us the $25,000 with compound interest - or I would like 3/4 of the owners to look at Unit 409 with Eleanor Pedersen and explain to me over a cup of tea what she did to deserve repairs and what I did to become so victimized. I would apply to the Supreme Court for an order if that was appropriate, except that it is not, as I could never present evidence effectively, represent myself properly, or afford to get a lawyer to obtain the required order, all of which is NO SECRET!

When it came to members of the strata management team preemptively cutting down trees around Unit 409 contrary to s.71, poisoning me with toxic fumes, and torturing me with defamation, oppression, and harassment, no claim was made for vandalism to common property or personal injury to me.

Labels: Strata Insurance, Strata Lawyer

1 Comments:

Which is the best service among those listed in this site?

Homeowners Insurance New Jersey

Post a Comment

Subscribe to Post Comments [Atom]

<< Home